A pro-business and pro-jobs budget

BI Report || BusinessInsider

Photo illustration: Business Insider Bangladesh

The government has unveiled the budget for 2021-22 with a tax bonanza that will help businesses tackle the ongoing Covid-19 situation and create the much-needed jobs through expansion.

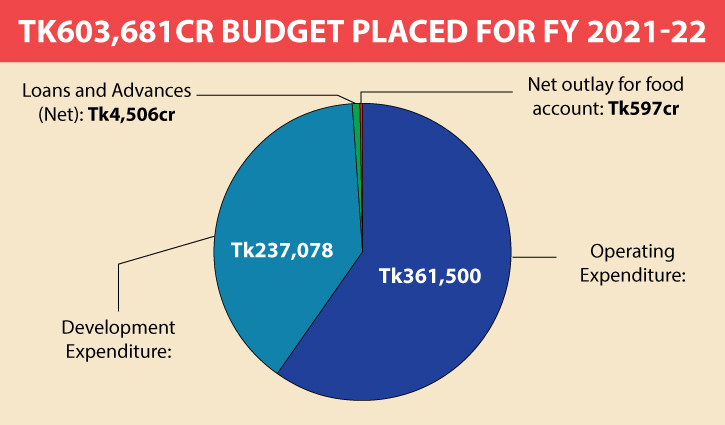

In the wake of the unprecedented onslaught that the pandemic has created on business, economy and employment in the country since March last year, Finance Minister AHM Mustafa Kamal placed a budget that is worth Tk 603,681 crore or 17.5 percent of GDP.

The finance minister has tried to put the country back on a recovery path following a slump caused by Covid-19 and the consequent lockdowns.

While businesses have hailed the budget for a 2.5 percentage point cut in corporate taxes, be it for listed or non-listed companies, non-business people have become despair to see the ‘as usual’ budget for the health and education sectors.

Here are a few hits and misses of the budget for the next fiscal year starting on July 1, 2021.

The finance minister has promised a budget to ward off the economic devastation caused by the pandemic, which rendered millions out of jobs, shuttered scores of small businesses, and snuffed the spending power of the low- and mid-income group.

A significant fall in consumption demand even before the pandemic, while tackling the fiscal deficit heightened by the crisis is no easy task!

The dismal backdrop with which the budget proposals were presented entailed a massive contraction in the GDP. The budget for FY22 projected GDP growth 7.2 percent from 6.1 percent estimated for the outgoing fiscal year, which was revised down several times from more than 8 percent.

This contraction has been associated with a decline of the several developmental indicators characterising an unprecedented decline of the economy.

Hence, the revised estimate of fiscal deficit including grants was 5.1 percent of GDP in FY21, and the new budget estimated it to be 6.1 percent in FY22.

In the global context, Bangladesh’s deficit challenge is not too much. Other countries are seeing their fiscal deficits balloon as they fight the pandemic.

The finance minister announces that the government will borrow around Tk 2.12 lakh crore in FY22, adding that the expenditure for the next fiscal has been pegged at more than Tk 6 lakh crore.

As the government navigates the tightrope of balancing economic growth and addressing fiscal concerns, a hike in infrastructure spending in the budget holds the potential to deliver higher economic growth.

While the finance minister has shown the intention of moving forward, the question is: in what way will the expenditure help achieve the developmental goals?

It is no surprise that health infrastructure comes as the highest priority for the government during the pandemic year, as the finance minister announced an outlay of Tk 32,731 crore to address the impact of the Covid-19 pandemic, accounting for only 0.95 percent of GDP. This is even less than the current fiscal year’s revised budget of more than 1 percent of GDP.

One needs to also look at the proposals for physical and financial capital and infrastructure. The budget proposes a sharp increase in capital expenditure having provided Tk 32,660 crore, a massive rise of more than 54 percent from the outgoing fiscal year. This will help macroeconomic growth. Additionally, it is also expected to create short and medium-term employment, thereby helping the cause of boosting domestic consumption demand. It is important to note here that the country’s growth story has so far been a public consumption-led growth.

Benchmark stock index DSEX gave thumbs up to the government’s ‘expansionary budget’ as Kamal chose the path of additional borrowing instead of taxing the super-rich or raising taxes on high-income individuals.

Even though the tax-GDP ratio is comparatively low, taking the pandemic into account, the finance minister announced various types of tax exemption, reduction in rate or tax benefits related to corporate tax, VAT, and customs duty, which will help industrialization and employment generation.

To develop human resources, the finance minister announced that steps will be taken to enhance efficiency as per the demand of the market at home and abroad. But no specific measures were mentioned in the budget speech.

Where does it lose out?

Yet, some issues are missing in the proposed budget.

Among those, the first is the universal pension scheme. The finance minister missed the issue that is important because of the rising inequality in Bangladesh.

Although the government announced multiple packages during the pandemic to revive domestic demand, the issue of consumption has been a major problem even before the pandemic. Despite that, individual income tax has not been reduced as a step towards boosting disposable income.

The purchasing power of the middle and lower-income groups has been heavily hit by the pandemic, and income disparities are increasing. The government must realise that the widening income inequality is readily becoming an impediment to economic growth.

To sum up, only time will decide the efficacy of the development goal for the country’s post-pandemic economic recovery process. While most and if not all the policy announcements do act as propellers to growth, the announcements of some policies deserve full marks but what needs to be seen is the implementation and that is key in making this a success.