Why UK-India FTA talks worry Bangladesh’s apparel exporters?

BI Special || BusinessInsider

Graphics by Business Insider Bangladesh

It seems the UK and India are very serious about a free trade agreement (FTA), for which the British government on Tuesday started the process, including consultation with businesses and other stakeholders on a prospective deal.

According to a timeline, the two countries are supposed to conclude the pre-FTA talks by the end of this year. Then India and UK are expected to take up an interim trade deal that would be concluded by early or the middle of 2022.

If the deal is signed, it can be a matter of grave concern for Bangladesh’s garment exporters. Why?

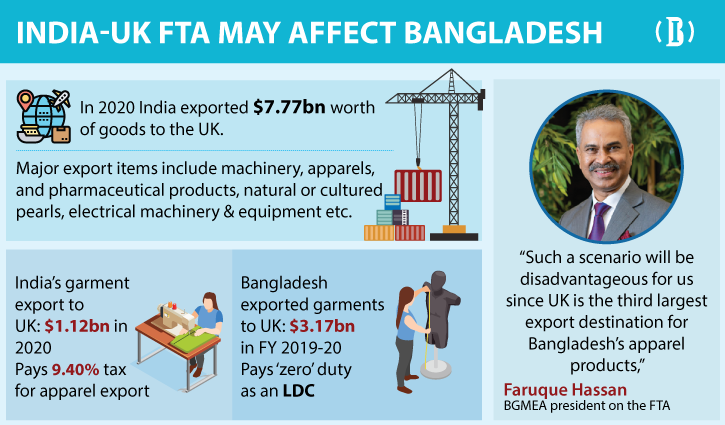

The UK is the seventh largest export destination for India with a 2.82 percent share of India’s total export in 2020. Also, the UK is the third largest market for India’s apparel export with a 9.18-percent share.

India is currently enjoying the General Framework (which is similar to EU Standard GSP) scheme from the UK and pays only 9.40 percent duty on its apparel products particularly. The bilateral FTA between the countries will slash the tariff to nil.

Currently, Bangladesh enjoys duty-free access to the UK for its apparels under “Least Development Country Framework” scheme. This indicates that once the UK-India FTA comes into effect India will gain a price preference by 9.40 percent on Bangladesh.

More concerning issue is that Bangladesh will lose the “Least Development Country Framework” preferences in 2029 and will either have to qualify for Enhanced Framework, which is similar to EU’s GSP Plus or General Framework where countries have to pay reduced rates of duty. That means beyond 2029 Bangladesh may have to pay duty to the UK while India would enjoy duty-free access because of the FTA.

“Such a scenario will be disadvantageous for us since the UK is the third largest export destination for Bangladesh’s apparel products,” said Faruque Hassan, the newly-elected president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

In the financial year 2019-20 Bangladesh exported apparels worth $3.17 billion to the UK, accounting for 11.35 percent share of Bangladesh’s total RMG exports. On the other hand, UK is the third largest destination for India’s apparel export, which was $1.12 billion in 2020.

The FTA will be significantly helpful for India to boost its export to the UK, which may cause diversion of trade from other supplying countries including Bangladesh, exporters said.

“Our export to the UK will be affected because of the FTA (if signed). Profit margin will also be reduced,” said MA Jabbar, managing director of DBL Group that exported $500 million worth of apparel products in FY 2019-20.

The BGMEA president sheds light on how Bangladesh can tackle the challenge.

Bangladesh needs to take a strategic business plan and action to enhance its efficiency, inspire design and innovation, add more values to its products and invest more in backward linkages to offset the impact of such dynamics in tariff to some extent, he suggested.

“At the same time, the diplomatic efforts with the UK and other potential apparel markets need to be ramped up to ensure market access as well as to explore opportunities in new destinations,” he suggested.

Data show during 2014-2019 India’s total export to the UK declined by 1.86 percent, and in 2020 export went down by 11.70 percent. On the other hand, Bangladesh’s total export to the UK rose by 7.40 percent during the FY 2013-14 to the FY 2018-19, and declined by 17.17 percent in the FY 2019-20.