Indian ban on cotton exports likely to hit Bangladesh hard

Jannatul Ferdushy || BusinessInsider

Business Insider Bangladesh Graphics

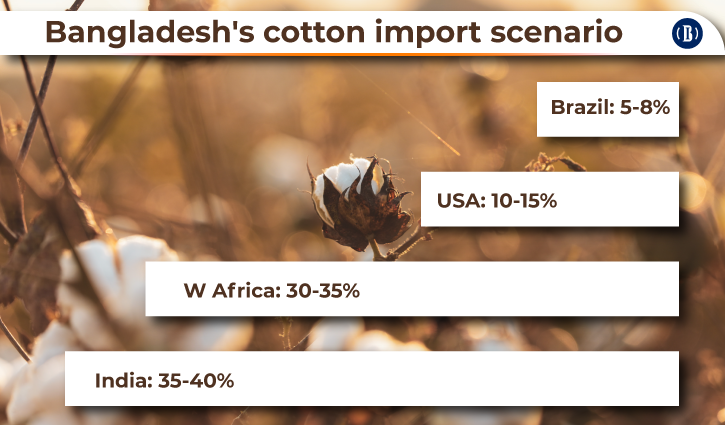

India, one of the largest cotton sourcing destinations for Bangladesh, may impose a temporary ban on its natural fibre shipment for a high demand at home, according to media reports.

Though the Indian government has yet to provide a formal announcement, Indian exporters have already stopped shipping raw cotton to global markets since Thursday.

Industry insiders believe Bangladesh’s textile millers may face a 35 percent to 40 percent yarn shortage and subsequent price shock, very soon.

“I have seen it (the advertisement) on the Indian Ministry of Textile’s website, but did get any official notification,” Muhammad Ali Khokon, president of Bangladesh Textile Mills Association (BTMA) told the Business Insider Bangladesh on Saturday.

Bangladesh became largely dependent on Indian cotton since the outbreak of Covid-19 more than two years ago.

“As we are dependent on Indian cotton, such a moratorium will deepen our cotton crisis. Bangladesh may face more than 40 percent of yarn crunch from July,” Fazlul Hoque, vice president of BTMA and managing director of Israq Textile Mills Limited, told the Business Insider Bangladesh.

As the price is incessantly spiralling in the global market, this ban will fuel the price rise once again, he said.

“The other large cotton seller to Bangladesh, West Africa, may also take advantage of the embargo, which will make prices sky-high,” he further said.

At present, cotton costs $1.5 per pound, whereas it was $1.30 around six months ago. After the ban, the price may exceed well over $2 per pound, textile millers feared.

“As the supply chain was disrupted during the pandemic, we enhanced our cotton imports from neighbouring India. If India suspends cotton exports, Bangladesh’s yearn production will stumble as other cotton-producing countries yet to resume trading in full phase,” said Proprietor of Asian Composite Mills Ltd, Mohammad Masud Rana.

He further said, “Because of the geographical proximity, we could import cotton and ship apparel in three months. In a new situation, it will take much longer.”

Rana is afraid Bangladesh will face severe consequences.

“The magnitude of the problem is we need to open three times more LC for one consignment,” he pointed out.

To make the price affordable in the retail market, the Indian government waived 11 percent of customs duties on imported cotton until September. But, still, they could not cut the prices. Therefore, the government decided to put a moratorium on exports.

According to the Indian Ministry of Commerce, this year cotton production decreased by 18 percent for to a drought-like situation in Punjab, the largest cotton-producing state in India.