Fintech remains untapped in Bangladesh

BI Report || BusinessInsider

Photo illustration: Business Insider Bangladesh

Bangladesh has one of the largest unbanked populations. As they do not have bank accounts, their economic activities are not enlisted as part of the formal economy.

Fintech (also known as financial technology) has been initiated in the country, though later than other neighbouring countries. It brings a sense of relief among those financial service receivers.

FinTech aims to reduce loads of traditional financial methods to deliver financial service by the inclusion of technology. Also, it accelerates the pace in the distribution of financial services.

In other words, Fintech in Bangladesh has reformed the traditional payment processing.

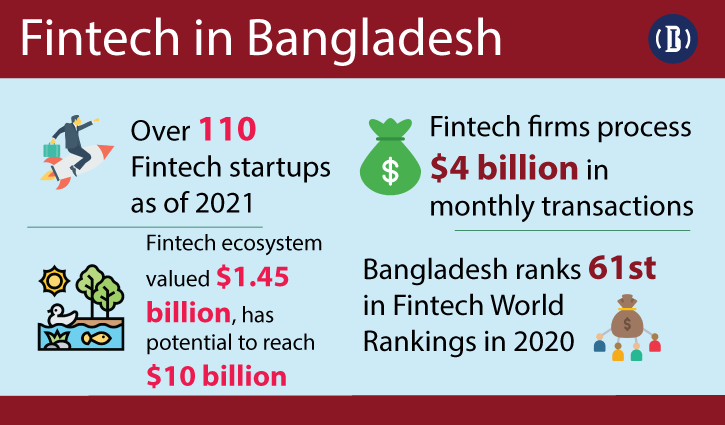

As of 2021, there are approximately 113 Fintech startups across the country, while Bangladesh ranks 61st in the global ranking, according to a recent Foreign Investors’ Chamber Of Commerce & Industry (FICCI) publication.

It also says that the current startup value is $1.45 billion which has the potential to reach $10 billion in this Fintech segment.

Regarding the growth of Fintech in Bangladesh, Mastercard Bangladesh Country Manager Syed Mohammad Kamal said that the range of transactions using Fintech has increased than before.

“However, our neighbouring country like India is advanced as we prefer cash transactions more than digital ones.”

The average monthly transaction in Fintech is around $4 billion, and most of the transactions take place through the mobile financial service (MFS) providers for paying salaries of the readymade garment workers, disbursing stimulus packages, and safety net funds to people in remote areas of the country.

Besides, the financial inclusion in Fintech was 16 percent in 2011, and it increased to 37 percent in 2018.

AKM Fahim Mashroor, co-founder and chief executive officer of bdjobs.com and AjkerDeal, said that Fintech is a wide arena, and Bangladesh is lagging behind in the race.

“Now, around 90 percent of transactions take place in cash instead of digital modes at Ajkerdeal.com,” he said.

According to Mashroor, Bangladesh is lagging in the Fintech segment as the idea has arrived late in the country.