How banks may offer clients some personalised insights amid economic stress

Kafi Khan || BusinessInsider

Kafi Khan.

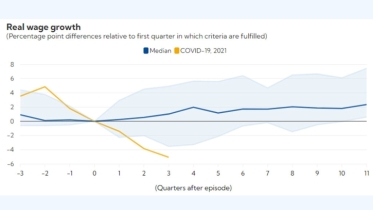

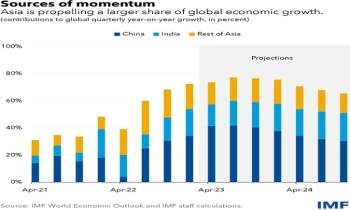

Due to the current economic stress, most of the consumers are now concerned about the impact of rising prices and inflation in their everyday life. In response, consumers have already started budgeting their spending on non-essential products and finding other ways to make ends meet, including reducing home energy use, visiting less to the restaurants, cancelling large purchases and vacations.

Based on their previous inflationary experiences, consumers now tend to purchase essential items and durables like necessary appliances and furniture as they use their discretion for economic reasons.

They also feel a greater need for savings and creating reserve funds. The decision between spending and savings usually is impacted by the intensity and rate of inflation.

Required responses:

The near-term off the end of the pandemic, there are increasing inflationary pressures that are impacting every citizen, putting financial wellness at risk for the households at all levels of the demographic spectrum. Financial institutions are in a position to assist their customers with financial education, personalised recommendations and even targeted relief. Whether banks will respond in a way that illustrates an understanding of the customer, an empathy for the challenges being faced, and a recognition of the opportunity for loyalty in the future. So far, the situation demands for available technology and insights by the financial institutions to manage expenses at the optimum possible level. During this economic uncertainty, it is important for banks to realize and respond to the concerns of the clients around financial well-being that also impacts mental health, physical health, productivity and even social engagement.

Consumers’ demand:

Financial wellness is the ability to make confident, well-informed money-related decisions resulting in financial security for both the short and long term. To achieve financial wellness in times of stress, consumers want their financial institution to support their financial well-being, assisting in giving them confidence in their ability to spend, save and invest safely. Customers want more than just chatbots and account updates from their financial institution. They expect proactive digital dialogue that provides ways to improve their financial security.

Bank should care about the financial pressures of consumers: This is the time financial institutions should help enough. So far consumers may require more help from their banks when it comes to managing their money, consumers may ask to know more from their financial institution regarding the economy. Consumers may require more communication from their banking provider to be happy about the generic advice. In fact, consumers want to be experienced and to get a feeling that their bank does understand their financial needs at this time and care about their problems.

Consumers want to see empathy:

Consumers want their financial institution to know them, understand them, and reward them with solutions that meet their individual needs. Most importantly, customers want their financial institution to be proactive in the recommendations offered and solutions created to better manage finances.

Return for banks:

The current economic environment provides a unique opportunity for financial institutions to assist their customers across the entire customer lifecycle. Rather than waiting for a customer to take action, the payoff for delivering proactive, personalized advice and solutions has never been greater. If financial institutions leverage their existing data and insights accumulated over years of transactions and behaviors, there is the ability to retain current customers, grow relationships and acquire new customers in a hotly contested competitive environment. Study reveals, most of the banking customers would consider switching to an organization that offers better money management features. In particular, consumers want help growing their savings and assistance with their everyday budgeting and money allocation. Consumers also want financial insights delivered that are contextual and personalized.

Concluding judgements:

Very importantly, it needs to harness real-time data to generate insights by using behavioural science and data science to deliver services, products and pricing that are context-specific and relevant to customers’ manifest and latent needs during economic stress. Those banks that will seize the challenge most rapidly and deliver true end-to-end hyper-personalized products and services will create a significant advantage over their competitors and will master to make significant progress in terms of differentiating their brands and multiplying their revenues. Above all, these banks will also play an active corporate citizenship role by reducing the risk of financial exclusion.

The author is the company secretary, The City Bank Limited. The opinions expressed in this column are that of the writer.