USA roadshow to woo foreign investors into stock market: Salman F Rahman

Sheikh Sazid || BusinessInsider

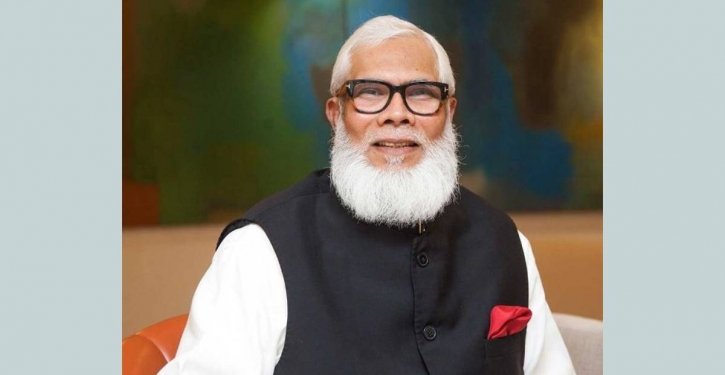

Salman F Rahman. Photo: File

Prime Minister Sheikh Hasina’s Advisor for Private Industry and Investment, Salman F Rahman has said Bangladesh Securities and Exchange Commission (BSEC) is going to organise roadshows in the USA to attract foreign investors into Bangladesh’s stock markets.

He made the remarks while talking to the Business Insider Bangladesh in the United States, on Friday. The roadshows have been scheduled for July 26 to August 2.

The promotional campaign that will highlight luring foreign investments into the country’s bourses and aware expatriates about investment opportunities, will take place in New York, Washington, Los Angeles, and San Francisco, respectively.

As part of a series of roadshows to attract investors abroad, BSEC had organised one in Dubai earlier this year.

“The importance of roadshows in the development of the country's capital market is immense. Through the event, foreigners and expatriates will be able to know all the details about the country’s stock markets,” he said.

“American businessmen and expatriates living here will also be able to know about the capital markets of Bangladesh through the roadshows,” said the PM’s advisor.

A stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place. Such financial activities are conducted through institutionalized formal exchanges or over-the-counter (OTC) marketplaces which operate under a defined set of regulations.

Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. Investment is usually made with an investment strategy in mind.

Salman said the efforts are also on to revitalize the bond market in the country, which is a positive sign for the country's stock markets.

He said, “I’ve seen the new capital market for over a year. The new commission (BSEC) has taken many good steps. New bonds are coming. The Islamic bond Sukuk has already been approved. Overall, I think the capital market has a bright prospect in the future.”

Over the last one year, DSEX, the benchmark index of the Dhaka Stock Exchange, saw a robust performance as it surged more than 58 percent to 6,405 points. The index hit its highest since its introduction in 2013.

Also, the DSE market capitalisation increased by almost 70 percent to nearly Tk 5,352 billion in a year.

Since the current team led by Prof Shibli Rubayat-Ul-Islam took the charge of the BSEC in May last year, investors continued to cheer up the stock markets.

Bangladesh’s capital market yielded the highest returns in 2020 among Asia's emerging economies, according to Bloomberg.

Stock investors got back their confidence due to some reforms taken by the BSEC to bring about discipline in the market, according to market experts.

The new BSEC team started to streamline the stock markets after the end of the nine-year tenure of M Khairul Hossain. He served the BSEC as its chairman for the longest period in the history of securities regulator and was the only BSEC chairman whose tenure was extended twice and his last extension drew widespread flak.