Dhaka stocks slip for 3rd consecutive day

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

The country’s primary bourse, the Dhaka Stock Exchange (DSE)l, extended its losing streak for the third consecutive day, despite a few promising developments on the macroeconomic front.

Earlier on Monday, the IMF approved Bangladesh the much anticipated $4.7 billion loan. Also on that day, the central bank signed “partnership agreements” with 49 banks to disburse loans to exporters from its newly-formed Tk 10,000 core Export Facilitation Pre-finance Fund (EFPF). However, investors remained cautious in trading despite possible positive outcomes from the developments.

On the day, the transaction in the stock market started with the increase in the share price of most of the companies. At the beginning of the transaction, the main index of the DSE rose by 7 points. However, the upward trend did not last long. The index turned negative within 10 minutes of the transaction. After that, the index went up a bit, but after 10:30 pm, the index began to slide.

DSEX, the prime index of the Dhaka Stock Exchange DSE, declined 11.78 points or 0.18 percent to settle at 6267.05466 as against 6278.84113 points in the previous trading session. The DSE Shariah Index (DSES) fell 4.26 points or 0.31 percent to finish at 1366.00826. The DSE 30 Index, comprising blue chips, dropped by 6.23 points or 0.28 percent to close at 2219.59862.

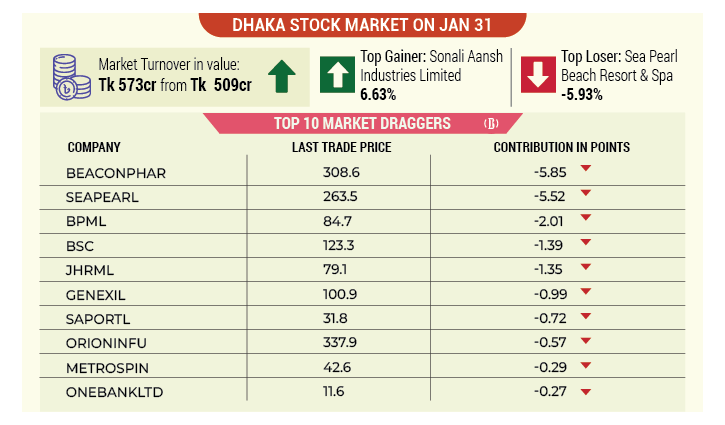

Turnover, a crucial indicator of the market, jumped by 12.48 percent and stood at Tk 573.09 crore at the end of the day. It was Tk 509.48 crore at the previous session on Monday.

Shares of the 327 issues were traded on the day, of which 31 closed in green, 135 in red and 161 showed no price movement.

SONALIANSH was the day’s best performer on the day, posting a gain of 6.63 percent. EASTERNLUB was the second-best gainer (4.42 percent), followed by POPULARLIF (3.56 percent), OLYMPIC (2.68 percent), and ORIONPHARM (2.65 percent).

On the other hand, SEAPEARL had the sharpest fall, shedding 5.93 percent, followed by BPML (-4.72 percent), JHRML (-4.70 percent), METROSPIN (-3.84 percent), and SAPORTL (-3.34 percent).

GENEXIL was the most traded by value with its shares worth Tk 57.92 crore changing hands on the day. SEAPEARL, which was the second most-traded stock, had a turnover of Tk 34.38 crore followed by BPML at 28.16 crore, EHL at Tk 27.15 crore, and OLYMPIC at Tk 25.86crore.

In the sectoral front, IT was the best performer in the session. The total turnover in this sector was Tk 101 crore, which was 22.59 percent of the total turnover. The Life Insurance sector was in the second position with Tk 50.90 crore turnover (11.38 percent), followed by Pharmaceuticals and Chemicals with Tk 46.80 crore (10.47 percent), Food and Allied 46.20 crore (10.33 percent), and Travel and Leisure with Tk 41.90 crore (9.37 percent).

The Chittagong Stock Exchange (CSE) also ended sharply lower with the CSE All Share Price Index - CASPI -losing 19 points to settle at 18513.6691 and the Selective Categories Index - CSCX shedding 11.90 points to close at 11097.7883.

Of the 155 issues traded, 27 declined, 65 advanced and 63 issues remained unchanged on the CSE.

The port city's bourse traded 14.81 lakh shares and mutual fund units with turnover value worth about Tk 12.14 crore.