Stocks subdued as sliding exports, remittances unnerve investors

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

Dhaka stock market went on the back foot on Monday after three days of a slight rally as the sliding exports and remittances spooked investors.

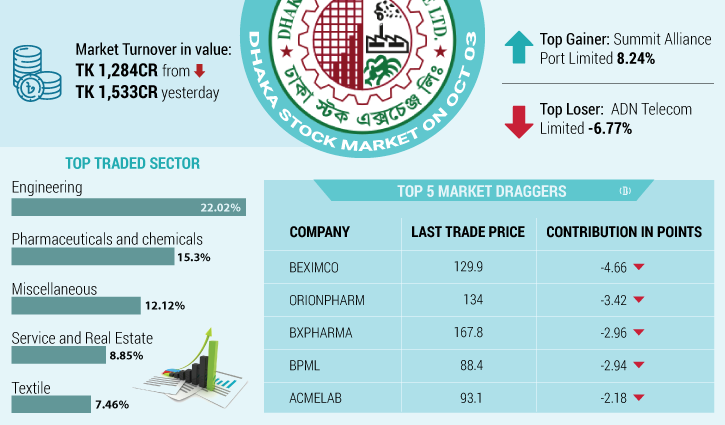

Dhaka Stock Exchange’s (DSE) benchmark index, DSEX, fell 13 points or 0.20 percent to 6,518 as many shares came under selling pressure after the first hour into the trade. The other two indices – DSES and DS30 also ended the day slightly lower.

The dampened mood of the investors was also reflected in the turnover or the total value of shares traded on DSE on Monday. A total of Tk 1,285 crore worth of shares traded hands on the day, down by over 16 percent from Tk 1,533 crore on Sunday.

Only 74 stocks gained, 122 declined and 178 remained unchanged on DSE.

On Sunday, Export Promotion Bureau and the Bangladesh Bank released data on exports and remittances for September respectively and it showed the two main sources of the country’s foreign currencies went into negative territory after many months.

After months of robust growth, Bangladesh’s merchandise exports declined 6.25 percent to $3.9 billion in September compared to the same month a year ago as shipments of garment products reduced along with some other key items.

Overseas Bangladeshis sent home $1.54 billion in remittances in September, down by nearly 11 percent year on year. Compared to the inflow of $2.03 billion in August, September’s receipts were down by 25 percent.

“Decline in exports and remittances affected the sentiment of the investors,” a merchant banker said. “Otherwise, there is nothing bad in the market,” he added.

Beximco Limited, Orion pharma, and Beximco pharma were the top three draggers, while Sea Pearl Beach Resort & Spa, Dutch-Bangla Bank, and Orion Infusion contributed positively to the indices on Monday.

Of the sector-wise turnover, engineering stocks accounted for over 22 percent of total turnover and pharmaceuticals and chemicals for 15.30 percent, DSE data showed.