How digital payment systems can boost Bangladesh’s push to meet the SDGs: WEF

BI Report || BusinessInsider

Business Insider Bangladesh illustrations

As we grapple with the challenges presented by the pandemic, Bangladesh continues to clock impressive growth and is in fact an outlier in the global economic scenario. Its gross domestic product (GDP) grew an estimated 5.2% in 2020 and is likely to grow 6.8% this year. In comparison, the global economy shrank 3.5%. Among Bangladesh’s neighbours, Pakistan, Sri Lanka and India are facing GDP contractions.

In fact, the IMF’s estimates indicate that Bangladesh crossed India's per capita GDP in 2020. Its unemployment rate, a shade lower than 4.2%, is the lowest among all emerging markets, and it remains on a downward trend. Under the leadership of Prime Minister Sheikh Hasina, Bangladesh is ready to grow out of Least Developed Country status in 2024 and on track to become the world’s 25th largest economy in 2035.

Bangladesh's growth spurt

The economy owes this buoyancy to its domestic strength, marked by a healthy agriculture sector, remittances and exports. Much of it comes from ready-made garments (RMG), a sector that despite the economic slowdown due to COVID-19 is still expected to remain a strong contributor to the economy for years to come. Bangladesh is now the second-largest global apparel exporter, following only China. Since taking its first steps towards exports in 1978, the sector has come to account for 84% of all exports and 12% of GDP. The industry also employs 4 million people, the majority of whom are women, who have been disproportionately affected by the repercussions of the pandemic.

While challenges remain, the sector has been investing in recent years in the improvement of working conditions, industrial safety, environmental sustainability, and modernizing and upgrading the production capacity to move up the value chain.

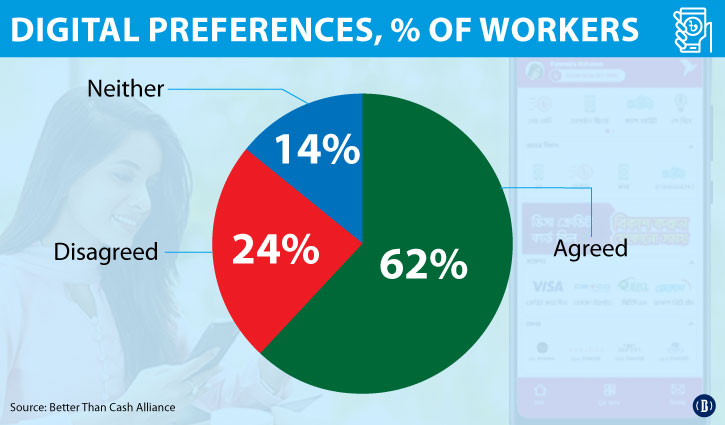

As the logical next step, the Bangladesh RMG sector has now embraced digital payments in a big way. In the wake of the pandemic, there has been an urgency to ensure that digital wage payments can be made to a maximum number of workers. Previous investments made in and promotion of digital payment technology have now become of enormous value.

Digital wage payments generally help workers, not only to have better control over their wages and access other financial services, but also to help ensure that they receive correct and timely remuneration and benefits.

In November 2019, the government of Bangladesh, global garment brands, the International Labour Organization and Better Work, who are all members of the United Nations-based Better Than Cash Alliance, came together and committed to removing barriers to ensure that 90% of wages in RMG factories were paid digitally by 2021. Ironically, an unexpected boost came from the restrictions imposed because of the pandemic conditions. At the peak of the pandemic, in July, 87% of wage payments were digital.

This aligned with the government’s larger efforts to provide a stimulus package, announced in March 2020, of Tk. 5,000 crore (about $600 million) to maintain employment and pay workers’ salaries in export-oriented sectors, particularly RMG. The intent was to ensure the money reached the right recipients, for which digital payments were found to be the most suitable. All RMG factories had to digitize their payroll systems and submit mobile accounts of their workers if they wanted to access the stimulus funds. As a result, in two weeks of April alone, a whopping 1.92 million mobile accounts were opened. This positive outcome is part of a global trend fast-tracked by COVID-19, with estimates by international agencies reporting that 1 billion people have already received COVID-related wage protection or social protection-related money transfers.

Benefits beyond cash

The benefits of digital payment go beyond the amount of money involved – which is why both employers’ and workers’ organizations have been moving to cashless wage payments and digitalization of payrolls for some time.

Digital wage payments enable companies to minimize human interactions during financial transactions. Digital payments help address health concerns, reduce travel, and have kept markets and other commercial establishments less crowded. The recipients of digital money, in turn, spent more through digital means, such as in sending remittances and making other payments. They also increased their savings and ability to cope with unanticipated economic shocks.

A recent research paper from the World Bank (2020) found that in Bangladesh, paying garment factory workers’ wages digitally gradually leads to increased account use and savings, and greater financial capability.

Digital wage payments have increased workers’ likelihood of receiving the correct wages on time, and provided proof of remuneration at the agreed level. This helps to reduce wage-related disputes.

Given that a majority of RMG workers are women, digital payments put more financial power in their hands. This trend appears to offer women workers a greater say in family decision-making, which can result in benefits to mental health and self-esteem. Digital wage payments have benefited companies’ payroll services by decreasing staff time for payroll-related admin and finance functions by 53%.

All this came about because the government has engendered a digital transformation in the country, which has seen the number of internet users rise to 110 million. The Harvard Business Review recently classified Bangladesh as one of the “break-out economies” that has the potential to digitalize rapidly for both post-pandemic recovery, as well as longer-term transformation towards advancing the Sustainable Development Goals (SDGs).

Since peaking in July, digital wage payments in RMG factories have since been falling, to just 54% in November. This may be because the added incentive of the government stimulus has receded, or fully onboarding and integrating the digital wage systems to the operations of the factories has lagged. There is also a continued need for workers’ education about mobile finance and banking to build their confidence to use the system.

Responsible digital payments

As the economy rebounds, and we learn to live and work in this new situation, further investments in and broader use of digital wage payment systems are expected to increase - for both for wage protection and social protection purposes.

As we continue to live this “new normal”, we can expect that the transaction cost of digital payments will continue to come down, and that regulators, mobile service providers and fintech firms will all continue to explore new ways to provide for safe and smooth delivery of wages and other financial services.

Both employers and workers have a lot to gain.

Workers can receive incentives such as cashback, reward points, merchant discounts, easier loans from banks, access to savings products and sheer convenience. Going forward, they need to be educated in the skills needed not only to operate digital wallets, but also to be able to make informed financial decisions about saving, budgeting, spending their wages and accessing other financial services.

Users – especially women – need to feel protected from potential loss of money or privacy through fraud or unauthorized fees and use.

The government, employers’ organizations and global brands can play a key role in this process. For example, to offer a recourse mechanism to garment sector workers, the government worked with the Better Than Cash Alliance to expand the scope of an existing helpline to include digital payments. The helpline, called Amader Kotha (About us), was established in 2014 with funding through Gap Inc. and has served 1.5 million workers with a 99% success rate in resolving issues.

Apart from a toll-free helpline for awareness and issues related to payments, it is worth looking into interoperability of wallets, as well as other progressive payment systems to make life and work easier for users.

World Economic Forum published this article on its website on Friday (May 14): It was written by Tuomo Poutiainen, Country Director, Bangladesh, International Labour Organization and Dan Rees, Director, Better Work.