Yarn import falls as Russia-Ukraine war prolongs

Millers are concerned over unpaid bank credits

Jannatul Ferdushy || BusinessInsider

Graphics: Business Insider Bangladesh

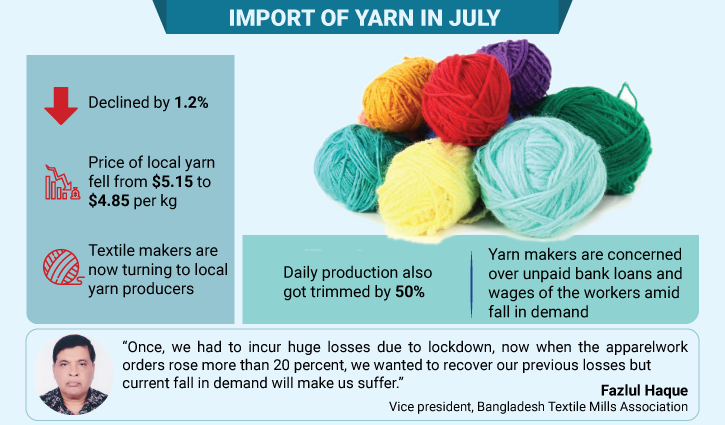

Import of yarn declined by 1.20 percent in July of 2022 as apparel export orders have fallen because of the global stagflation caused by the Russia-Ukraine war, according to Bangladesh Bank.

Industry insiders think, due to high inflation in the world, people have been prioritising food over the clothing. As a result, demand for clothes has dropped, influencing Bangladesh’s workload.

While yarn prices hiked in domestic markets, the readymade garment manufacturers started importing yarn from abroad but after the Russian invasion of Ukraine, the global trade scenario abruptly changed, too.

“As work orders for the winter season have fallen, the factories’ got less busy. So, we have cut yarn imports. Besides, yarn prices also decreased in the local market. Therefore, manufacturers are sourcing it from the home market,” Muhammad Hatem, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) told Business Insider Bangladesh.

A textile manufacturer agreed.

“Demand for yarn has fallen as the buyers are placing fewer work orders to us,” Fazlul Haque, vice president of Bangladesh Textile Mills Association (BTMA) told Business Insider Bangladesh.

Meanwhile, the price of local yarn fell from $5.15 to $4.85 per kilogram. Therefore, manufacturers are turning to local yarn producers, he said.

He said because of natural gas rationing, prices did not fall much. “If we get natural gas, as much as required, yarn prices may fall more. In the Maona and Gazipur area, the daily gas supply is shut from 6pm to 5am.”

According to BTMA, the daily production also got trimmed by 50 percent, of which 30 percent is sold out and the rest 70 percent is in stock. Yarn manufacturers said due to the fall in demand, they are becoming concerned over unpaid bank loans and wages of the workers.

The yarn manufacturers pocketed as high as about 100 percent profit just a couple of months ago as yarn prices were hiked. But, now, they are suffering, yarn manufacturers said.

Fazlul Haque said, when work orders surged in the country, yarn manufacturers invested to expand their production lines.

However, only 5 percent of factories came into operation, the rest 95 percent are sitting idle and counting the interest of bank loans, he said.

“Once, we had to incur huge losses due to lockdown, now when the apparel work orders rose more than 20 percent, we wanted to recover our previous losses but current fall in demand will make us suffer,” he added.

In July 2021 the price of poly-cotton in India (recycle) was $3.15 per kg which was $ 4.50 in the local market at that time. Indian cotton got $3 in August against the local market’s price of $4.45, according to apparel manufacturers.