Remittances exceed $2bn for 2nd consecutive month

BI Report || BusinessInsider

Business Insider Illustrations

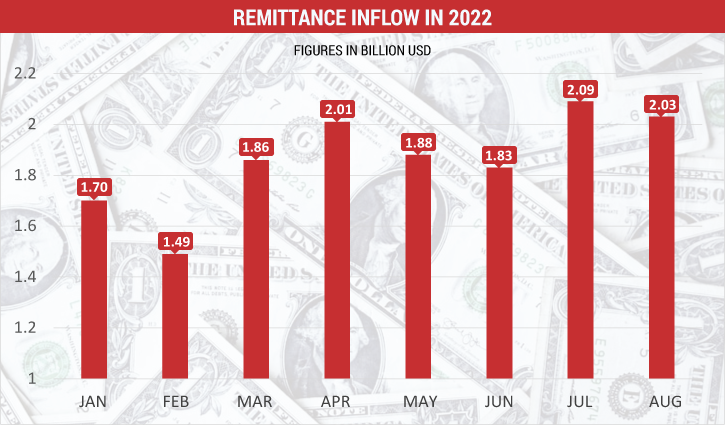

Bangladeshi expatriates sent back $2.03 billion in remittances in August; a development that will help improve the country’s depleting foreign exchange reserve.

According to Bangladesh Bank data released on Thursday, the inflow of remittances in August was 12.60 percent higher than the same month a year ago. However, the inflow was slightly lower than $2.09 billion in July, the first month of fiscal 2022-23.

Amid the declining foreign exchange reserves due to the rising import bills, many private sector banks are now bringing in home more remittances than the public sector ones.

Different private banks are buying dollars at a higher rate than state-owned ones, which is helping them get more remittances, bankers said.

In August, Islami Bank channeled the highest $430 million, Agrani Bank $132 million, Pubali Bank $114 million, Dutch-Bangla Bank $101 million, and Rupali Bank $100 million in remittances.

Bangladesh saw its inward remittance drop by 15.12 percent to $21.03 billion year-on-year in FY22 after growing by more than 36 percent to $24.78 billion in FY21.

The gap between the supply and demand of the dollar has been pushing down the country’s foreign exchange reserve. As of Wednesday, forex reserves went down to $39.05 billion, down from $39.59 billion in July and $41.82 billion in June this year.

As a result, the impact was on the exchange rate. The interbank exchange rate stands at Tk 95, up from Tk 86.50 for a dollar in the middle of April.

This dollar is much stronger when it comes to LC settlements. Banks are charging their clients as high as Tk 105-107 for a dollar.