Top bankers hint pressure on forex likely to reduce in 3 months

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

Taka has come under pressure since the beginning of 2022 as surging commodity prices fuelled the inflationary pressure. The situation has intensified since February, especially with the invasion of Ukraine by Russia as these two countries are major suppliers of wheat, sunflower, oil, gas, and some other commodities.

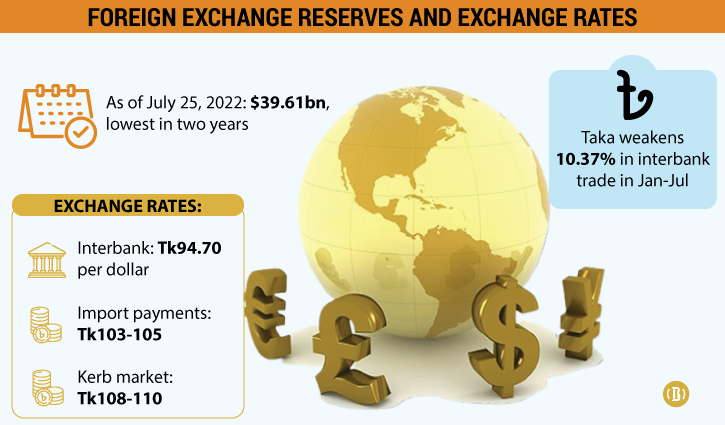

Like elsewhere in the world, Bangladesh also felt the pinch of this rally in commodity prices as the country is a net importing nation. As a result, all pressures came on the foreign exchange, particularly the demand for the US dollar shot up and it gained over 10 percent in interbank trade between January and July so far this year.

To deal with the challenge, the government and the Bangladesh Bank have taken a number of measures, including a cut in the consumption of fuel and electricity and limiting spending on less important projects.

Also, the central bank has taken steps to curb imports of luxury and non-essential items in a bid to tighten the demand side. The BB has also taken steps, such as a cut in the bank’s net open position of foreign currency and encashment of export proceeds faster to boost the supply of the greenback.

But the question is when these measures will start paying off?

The Business Insider Bangladesh talked to three managing directors of three leading private banks to understand their views on the steps taken so far. All of them said these are timely steps and will have a positive impact in the next few months.

“Pressure in imports has slowed down. Also, the commodity prices in the international markets are coming down,” said Selim RF Hussain, managing director of BRAC Bank and chairman of the Association of Bankers Bangladesh (ABB).

He appreciated the central bank for its measures taken in the last two weeks to cool the demand and improve supply as well.

“I think the pressure on the foreign exchange will ease in the next two months,” said Hussain.

Hassan O Rashid, managing director of Prime Bank, also echoed Hussain about the import and commodity prices.

“Import is coming down because of the central bank’s move. Also, the commodity prices and freight costs are declining,” Rashid said, adding that the deal between Russia and Ukraine on grain exports will also cut the global commodity prices.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, however, said the time has not yet come to comment on a decline in imports.

‘Eid has just gone. Usually, imports are less during this time,” said Rahman. “It will take time to ease the volatility in the foreign exchange market,” he said.

Rahman said Bangladesh Bank has taken a number of steps, both for controlling the demand side and improving the supply side, but the impacts of these initiatives will come later.

Despite a healthy export growth in FY22, rising import bills and declining remittances have depreciated Taka against the US dollar by 10.38 percent in interbank trade till July 25 of 2022. Accordingly, Bangladesh’s foreign exchange reserves went down to $39.61 billion on Monday, the lowest in two years.