Apparel makers increase yarn imports amid global cotton crisis

Jannatul Ferdushy || BusinessInsider

Graphics: Business Insider Bangladesh

Considering the demand for cotton and its production, it appears that there is a scarcity of this natural fibre across the globe that hits Bangladesh, too.

Industry insiders said apparel manufacturers of Bangladesh have boosted yarn imports while responding to an extra-ordinary shipment orders and possible supply crunch of cotton.

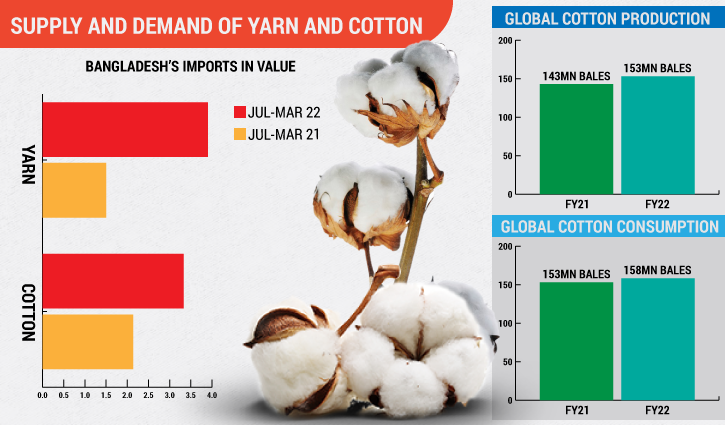

The United States Department of Agriculture (USDA) report says that global cotton production is projected at 1,531 lakh bales for 2021-22 compared to 1,439 bales of the previous year. However, the consumption of cotton is expected to remain 1,588 lakh bales, some 57 lakh bales more than what it was in the last year.

“We have to cut 20 percent yarn production due to scarcity of cotton. Moreover, the supply chain has yet to be normalised after the Covid-19 pandemic,” Fazlul Haque, vice president of Bangladesh Textile Mills Association (BTMA) and proprietor of Ishraq Spinning Mills Ltd, said.

He told Business Insider Bangladesh that locally made yarn demand has decreased by 15 percent due to inconsistent supplies of cotton.

“The readymade garment manufacturers who have the bonded warehouse licenses, have intensified their own yarn imports from the global markets though they will face a cotton crisis in the near future,” he said.

He said he himself started importing yarn in August ‘21 due to its high price in the local market.

Like him, Muhammad Hatem, Executive President of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) is also importing yarn.

“I am currently importing 20 percent of my yarn demand. A scarcity has been created following the current circumstances and that is why the garment makers are compelled to increase yarn import,” Hatem told the Business Insider Bangladesh.

The USDA report says some of the cotton producing countries are suffering from the advent of monsoon and some of the countries started organic farming which caused cotton production to fall.

China’s cotton output also fell by 3 percent in December ‘21 year on year, according to the National Bureau of Statistics (NBS). Meanwhile, South Africa also projected for a reduction by 13 percent in ‘22, Cotton SA data shows. The Cotton Association of India (CAI) has reduced cotton crop production by 2.33 percent, estimated for 2021-22.

Meanwhile, during July-March period of 2022, Bangladesh imported yarn worth $3.90 billion while raw cotton $3.33 billion, according to Bangladesh Bank.

And, during the corresponding period of the last year, yarn imports aggregated $1.5 billion and cotton $2.14 billion, respectively, BB data shows. Of these, yarn import has increased by 161 percent year on year while raw cotton 56 percent.

Bangladesh’s prime export product apparel is dependent on availability of cotton yarn. During the ten months (July-April) of the current fiscal year, the sub-sector fetched $36 billion in export revenue. According to the target set for ’22, the export will stand at $43.5 billion.