Economic Association proposes Tk 20.5 lakh crore alternative budget for FY23

BI Report || BusinessInsider

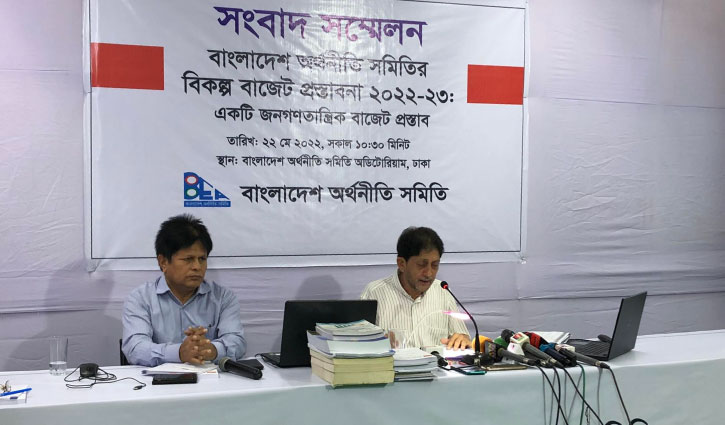

Photo: Business Insider Bangladesh

Bangladesh Economic Association (BEA), a forum of economists, on Sunday proposed an alternative budget of Tk 20.50 lakh crore, which is more than three times the outlay for the outgoing year.

BEA had proposed a Tk 17.38 lakh crore budget for the fiscal year 2021-22, higher than the government allocation of Tk 6.03 lakh crore.

The association on Sunday issued a press release with the title “Alternative budget proposal 2022-23: A democratic budget proposal”, detailing the proposal along with the goals the budget should strive for.

According to the proposal, of the total Tk 20.50 lakh crore budget, Tk 18.70 lakh crore will come from the government’s revenue collection with a Tk 1.80 lakh crore will remain as a budget deficit —15 percent less than the current deficit.

However, the proposed budget suggests that external sources will not play a role in financing the deficit,

At the same time, the proposal also suggests not taking loans from domestic banks to meet the budget deficit. Because the loan money taken from domestic banks can be used for other purposes.

How to pay deficit….?

The proposal informed that the total amount of black money generated in Bangladesh in the 47 years from 1972-73 to 2018-19 is estimated at Tk 88.61 lakh crore. The amount of laundered money is around Tk 7.98 lakh crore.

In the upcoming 2022-23 financial year, the proposal recommends the recovery of at least 2 percent (Tk 1.77 lakh crore) of black money and 10 percent (Tk 79.83 thousand crore).

BEA believes the recovered money could finance the budget deficit.

Other than these two, BEA proposed widening and adding taxes in several local sources to finance the deficit. It suggested wealth tax, tax on excess profits, tax on luxury goods, cancelling car tax exemption on MPs and others, tax on foreign nationals, tax on services, air transport and travel tax, income from royalty and assets, sale of government assets, receipts for irrigation, wire and telephone boards, telecom, regulatory Commission, energy regulatory commission, insurance Regulatory Commission, securities and exchange commission, municipal holding tax, DG health, private hospital permission and renewal fees, pharmaceutical license and renewal Fees, beauty parlour services tax, hotel capacity tax, foreign consultation Fees among others.

Moreover, annual estimated inflation should be kept between 5-7 percent. Inflation cannot be allowed to reach a level that will put the economy in a vicious cycle of inflation. cannot be increased under any circumstances.

The budget proposal warns that the country’s economy may fall into a severe crisis when repayments of foreign loans taken for megaprojects begins to pile up.

Calling the repayment period “red alert”, the proposal estimates the period to start from 2026-28.