Govt’s bank borrowing likely to hit Tk 87,288cr in FY22

Asif Showkat Kallol || BusinessInsider

Graphics: Business Insider Bangladesh

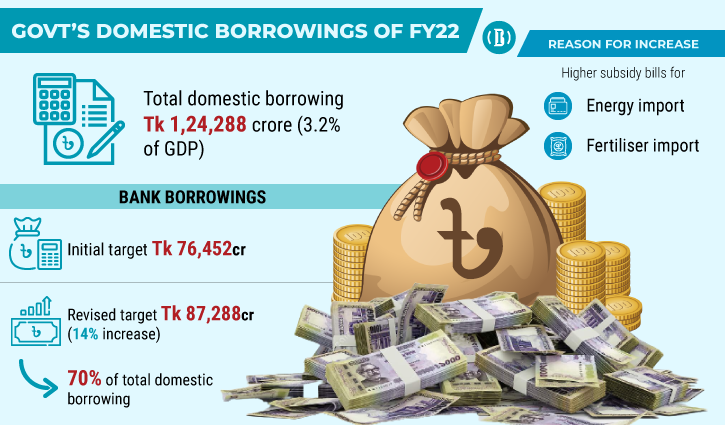

The government’s borrowing from the country’s banking systems may rise 14 percent to Tk 87,288 crore this fiscal year to meet the increasing subsidy expenses and rising debt servicing, officials said.

The finance ministry has estimated the government’s bank borrowing at Tk 87,288 crore in the revised budget for the fiscal 2021-22, which is 14.12 percent higher than the actual target of the current financial year.

The government is set to borrow 70 percent of its total scrounge from the banking system, officials said.

The total borrowing from the domestic sources will aggregate Tk 1,24,288 crore in the revised budget which constitutes 3.2 percent of the country’s GDP.

International commodity prices hikes have already enhanced the subsidy bills for fuels and fertilisers in the current fiscal year and are set to grow further in the next one beginning July.

The increases cannot be met merely by revenue income growth and it will require the government to borrow more from the banking system.

In the FY 2021-22 budget, the ministry set a target of borrowing Tk 76,452 crore from the banks. Despite a 15% increase in revenue collection in the first nine months of the ongoing fiscal year, Finance Division officials have fixed the bank borrowing target at Tk 87,288 crore in the revised budget to meet increasing expenses on the part of the government.

In a meeting of the fiscal coordination council and budget resources committee held on April 17 with Finance Minister AHM Mustafa Kamal in the chair, Bangladesh Bank Governor Dr Fazle Kabir termed the bank borrowing target in the revised budget ‘very abnormal.’

The country’s top think tank CPD recommendations revealed that in order to contain the budget deficit, the government should take measures to enhance domestic resource mobilisation and raise both capacities and efficiency of public expenditure.