Yarn, cotton price hikes sawing apparel makers, textile millers

Jannatul Ferdushy || BusinessInsider

Photo illustration: Business Insider Bangladesh

Demand for raw cotton shot up drastically as local yarn and fabrics importers raised their ceilings due to high demand for yarn in the domestic market.

Because of the raw cotton crisis in the international market, apparel manufacturers abruptly increased their yarn imports, statistics show.

Generally, textile mills of the country meet the major part of the domestic demand for yarn with their imported raw cotton.

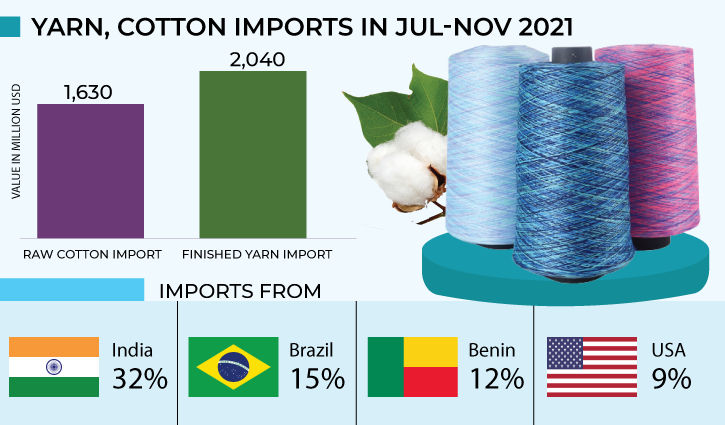

But during July-November, of ’21, import of raw cotton stood at $1.63 billion. The import of finished yarn stood at $2.04 billion which is $1.24 billion higher than the previous year’s import, statistics show.

Import of yarn has increased by 152.41 percent year on year while raw cotton by 61.33 percent in July-November ‘21, respectively, according to Bangladesh Bank.

The central bank data shows the volume of raw cotton imports was worth $1.01 billion in the last fiscal year when yarn imports aggregated $809.9 million, respectively.

According to the international media, raw cotton exporting countries could not ship adequate amounts of the produce due to shortage of containers and “go slow” strategy at the ports.

On the other hand, cotton production also went down because of strict lockdown caused by the covid-19 pandemic.

“I have been importing yarn since August due to its high price in the local markets. Currently, I import 20 percent of my requirement. For similar reason, other apparel makers also import yarn,” Muhammad Hatem, Executive President of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) told the business Insider Bangladesh, on Monday.

Another leader of BTMA cited another reason for the hike in yarn prices.

“We are facing uncertainty because of delayed shipments caused by dilly-dally procedures at the ports including our Chattogram port,” said Fazlul Hoque, vice president of Bangladesh Textiles Mills Association (BTMA).

Besides, he said, the container crisis has not been mitigated. Meanwhile, demand for yarn went way too far, this time. Therefore, fabrics and readymade garment manufacturers who have their bonded warehouse licenses, increased import of yarn from various sources.

“Now, ongoing gas crisis will cut more yarn production and subsequently its import will rise further,” Hoque said.

The buying pressure for domestic yarn will also rise as the country’s ready-made garment exports increased 28 percent to $28.5 billion in the first 10 months of FY 2021, as compared to the same period of the earlier fiscal.

Meanwhile, raw cotton suppliers are not able to keep their commitments made to yarn makers. “So, we are on the horns of a dilemma. The global supply chain gets scattered due to the port’s uneven activities,” he pointed out.

Of the total import of yarn 32 percent comes from India, followed by Brazil, 15 percent, Benin 12 percent and the United States, 9 percent, respectively.