Additional costs hold back growth in POS transactions

Zia Nazmul Islam || BusinessInsider

Business Insider Graphics

When the world is going for cashless transactions, card transactions in Bangladesh are rising, albeit slowly because of some chronic infrastructure bottlenecks and the mindset of users.

Consumers who prefer using cards blame the lack of infrastructure, such as the availability of point-of-sales (POS) machines at shops they use to buy everyday essentials. On top of that, many shops that have POS facilities charge extra from the customers.

This additional charge varies from shop to shop and the card used.

"I was not pleased when the seller wanted to charge an additional 1.6 percent for the transaction in card," said Sadek Hossain, a customer who bought a computer from Multiplan Computer City, one of the largest sale centres of IT components and accessories in the country.

Later, Hossain was forced to withdraw cash from two ATM booths using two different cards because of withdrawal limits.

This is not only Hossain's problem. It is an issue for many customers and is evident in the central bank's data on card issuance and transactions which remain very low compared to Bangladesh's economy of over $400 billion.

Both big business outlets and banks regularly roll out attractive offers to customers to make payments using cards. Instant cashback and special discounts are regularly seen at shops.

Yet, certain retailers ask 1-2 percent or more if paid by cards.

This can be seen mostly in smaller retail shops. Sellers in these small outlets claim they make little profit due to strong competition.

The transaction fee, when paid through POS machines, cut their profits, they say. Retailers, therefore, want that fee to be absorbed by the customers.

“There is no legal issue against retailers charging customers the transaction fee,” said Tauhidul Alam, Head of Merchant Business of City Bank Ltd, the country’s largest POS machine provider.

The card issuing bank charges 1.1 percent in merchant payments using POS of another bank under the National Payment Switch Bangladesh (NPSB) of the Bangladesh Bank.

“Retailers charge more than 1.1 percent because of different deals made between the merchant and the bank,” Alam said.

— Card and POS transactions in Bangladesh —

Bangladesh Bank data shows, there were a total of 2.97 crore local transactions using cards in the country in November ’21 amounting to Tk 25,455 crore.

From January to November 2021, monthly transaction numbers hovered between 2.5 and 3 crore. The transaction amount was between Tk 25,454 - Tk 19,778 crore.

In 2020, monthly transaction numbers were between 1.16 crore and 2.63 crore. The transaction amount was between Tk 8,947 - Tk 19,625 crore.

These numbers show a clear rising trend, but a gradual and slow one.

The number of issued cards are rising too month-wise is increasing too as most banks issue debit cards with banks accounts.

The number of issued debit cards in November last year was 2.61 crore, up from 2.56 crore the previous month. It was 2.19 crore in November 2020 and 2.10 crore in October.

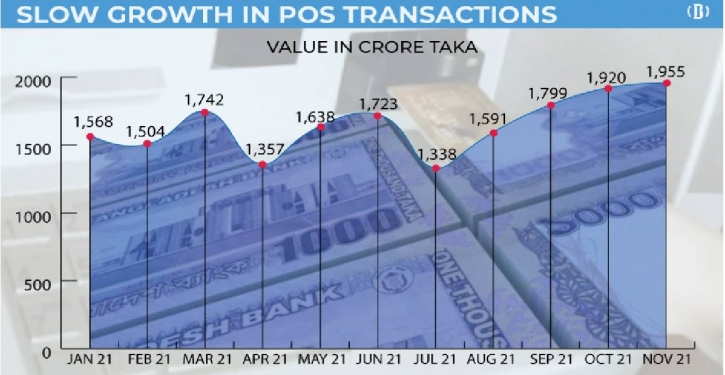

The number of POS transactions in November ’21 was 39.26 lakh amounting to Tk 1,955 crore. In the corresponding year in 2020, transactions through POS machines were 29.75 lakh worth Tk 1,472 crore—an almost 32 percent increase.