Tax rules need to be reformed: Speakers

BI Report || BusinessInsider

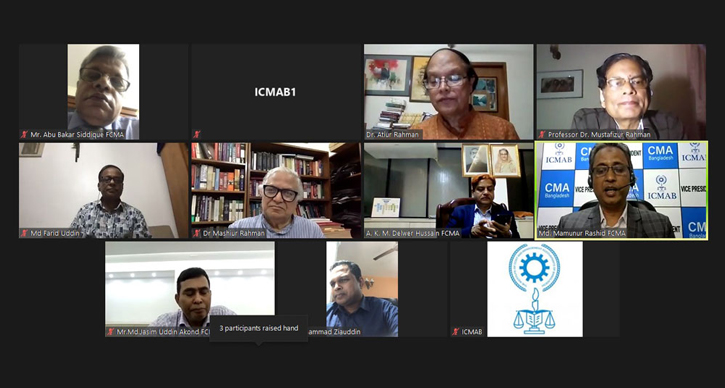

Screengrab of the webinar

The National Board of Revenue needs to be digitised, VAT and tax rules need to be reformed, incentives are required for women entrepreneurs and digital entrepreneurs, more incentives are needed on small and medium enterprises and health sectors.

Discussants at a pre-budget discussion webinar on the National Budget 2021-2022, organised by the Institute of Cost and Management Accountants of Bangladesh (ICMAB), made these remarks on Thursday.

They also emphasised on health insurance, employment generation, agriculture and education.

They also said that the government should be more prudence in resource allocation, the rate should be simplified in VAT Law and Income Tax Law and customs should be modernised.

Bangabandhu Chair Professor of the University of Dhaka and Former Governor, Bangladesh Bank Dr Atiur Rahman, Ambassador of Bangladesh, Germany Mosharraf Hossain Bhuiyan, Former Member of Customs and VAT and Former Chairman of National Board of Revenue (NBR) Md Farid Uddin, and Distinguished Fellow of the Centre for Policy Dialogue (CPD) Professor Dr Mustafizur Rahman joined the webinar as discussants.

Economic Affairs Adviser to the Prime Minister Dr Mashiur Rahman was present as the chief guest at the webinar.

Retd Member (Tax Survey & Inspection) of NBR Ranjan Kumar Bhowmic and Additional Commissioner of Customs of NBR Kazi Muhammad Ziauddin made a presentation on the salient features of the National Budget.

ICMAB Vice-President Md Mamunur Rashid moderated the session.

ICMAB President Abu Bakar Siddique offered an inaugural speech in the webinar. SAFA President A K M Delwer Hussain also shared his thoughts on the upcoming budget and Vice-Chairman of Seminar and Conference Committee of ICMAB Md Jasim Uddin Akond gave a concluding speech.

The paper presenters presented a number of proposals to be included in the upcoming National Budget. Among their proposals some salient points are —

-

Currently, the company submits their annual return along with Financial Statements certified by the Chartered Accountants Firms. It becomes impossible to check the cost of goods manufactured or the cost of goods sold or the cost of sales statements vertically and horizontally. Therefore, in the income Tax Act section 35 (3) (C), “quantitative analysis of cost statement should be signed by the Cost and Management Accountant (CMA)” words to be added.

-

In the existing law, there is no scope for Tax and VAT audit. By including this subject in the existing law, VAT and Tax can be audited by the professional accountants (Chartered Accountant/Cost and Management Accountant).

-

In act section 75, there is a provision of auditing with holding Tax return. In the act, there should be complete instruction and guideline on how to audit this.

-

Investment rebate in DPS (Deposit Pension Scheme) may be increased from Tk 60.000 to Tk 1,20,000.

-

According to act section 5, by keeping central VAT registration, SRO may be abolished.

-

In act section 45, at the time of export, adjustment of VAT and supplementary duty has to be mentioned clearly.

-

In act section 101(1)(ga)- For value-added tax, a minimum of seven years experienced lawyer or chartered accountants or cost and management accountant should be included.

Besides these the discussants have also given the emphasis on food and agricultural safety, medical and health security, national disaster management, industrialisation and capital market development, providing special incentives to the garments sector, special incentives for aviation and transportation.