Over 50% smokeless tobacco factories evade tax: Study

BI Report || BusinessInsider

More than 50 per cent of the country’s smokeless tobacco factories have managed to slip away from the government’s tax net, according to a study

More than 50 per cent of the country’s smokeless tobacco factories have managed to slip away from the government’s tax net, according to a study revealed on Monday.

UBINIG conducted the study titled “Factors Inhibiting Smokeless Tobacco Tax Payments by Smokeless Tobacco Manufacturers Operating Outside the Tax Net in Bangladesh” with assistance from Campaign for Tobacco Free Kids (CTFK).

The study findings revealed that among the 483 smokeless tobacco factories (435 of zarda and 48 of gul) of Bangladesh, only 218 pay taxes.

The study surveyed on 88 smokeless tobacco manufacturers (81 of zarda and 7 of gul), spanning over 29 districts of the country’s eight administrative divisions, which were out of the tax net and also revealed that 33 percent of them do not even have a valid trade licence.

As many a 91 percent manufacturers produce such products manually, the study also found that smokeless products are manufactured primarily in small unmarked factories or houses.

The total monthly gross turnover is estimated at Tk2.7 crore. The study identified that the ‘informal’ nature of SLT production as the main impediment in ensuring tax compliance in this sector.

Anti -tobacco campaigners and officials of National Board of Revenue (NBR) who were speaking at report launching webinar emphasised the need to bring all smokeless tobacco factories under the watch to boost revenues.

To disseminate the findings of the study with the NBR, the webinar was jointly organised on Monday by a number of anti-tobacco organisations, including National Heart Foundation, Dhaka Ahsania Mission, UBINIG, Voice and PROGGA.

The findings of the study were presented by Dr Nasiruddin Ahmed, the leader of the research team and former chairman of the NBR.

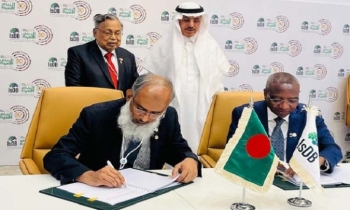

The welcome speech was delivered by Md Mustafizur Rahman, Lead Policy Adviser of CTFK, Bangladesh and former chairman of Bangladesh Chemical Industries Corporation (BCIC).

Discussion session was participated by a wide range of NBR high officials, leaders of the anti- tobacco organisations and experts including CTFK Research Director Maria G Carmona and CTFK South Asia Programs Director Vandana Shah.

Chief guest of the event Zakia Sultana, NBR member (VAT Audit and Intelligence), said, “SLT use should be reined, for the sake of revenues and public health. Reducing SLT use would also reduce health sector expenditure.”