Islamic banking booming in Bangladesh even in pandemic

BI Special || BusinessInsider

Graphics by Business Insider Bangladesh

Islamic banking industry in Bangladesh is increasingly getting stronger as more and more banks are being converted into shariah-based lenders. Banks that still follow traditional or conventional banking are also opening up Islamic banking windows to tap the market.

According to Bangladesh Bank data, as of December 2020, there were eight full-fledged Islamic banks in the country since the system first introduced in Bangladesh in 1983. Just a day after, the number rose to 10 as two conventional commercial banks – Standard and NRB Global – have turned into fully Islamic banks.

Moreover, nine commercial banks have 19 Islamic banking branches and another 14 banks have 198 Islamic banking windows. Jamuna Bank has the central bank’s approval to be a full-fledged Islamic Bank, but it is yet to launch officially.

More conventional banks are in the pipeline to open up Islamic banking windows. ONE Bank and UCB Bank have started Islamic shariah-compliant financial services through dedicated windows recently and Mutual Trust Bank has just launched the services on Wednesday. City Bank is working on to rebrand and expand its Islamic banking windows.

Why this rush for Islamic banking?

“Bangladesh is a Muslim-majority country and many people want to do shariah-based banking instead of conventional. We want to tap this opportunity,” said Syed Mahbubur Rahman, managing director of Mutual Trust Bank that has opened Islamic banking window on May 12.

Also, there are some flexibility with Islamic banking, such as less provisioning requirement and more investment opportunity, he said.

“Deposits and remittances are easy to get through Islamic banking,” said Mirza Elias Uddin Ahmed, managing director of Jamuna Bank.

According to bankers, the best thing in shariah-based banking is flexibility in rate of return on deposits and investments. For example, as there is sluggish demand for investments amid the coronavirus pandemic, Islamic banks share less profits with depositors, but conventional banks have to maintain the rate they agreed upon before.

Policy supports from Bangladesh Bank

Recently Bangladesh Bank on behalf of the government has issued sovereign investment sukuk, which will smooth liquidity management of Islamic banks, help financing budget deficit and promote Islamic capital markets to raise funds for infrastructure and industrial projects towards achieving higher inclusive GDP growth including sustainable development goals, the BB said in its last quarterly assessment on Islamic banking in Bangladesh.

Status of Islamic banking in Bangladesh

At the end of December 2020, eight banks in Bangladesh are full-fledged Islamic banks. They are: Islami Bank Bangladesh, ICB Islamic Bank, Social Islami Bank, Al-Arafah Islami Bank, EXIM Bank, Shahjalal Islami Bank, First Security Islami Bank and Union Bank.

Standard Bank and NRB Global Bank have joined the league on January 1, 2021. Jamuna Bank has the central bank’s permission, but its board has not yet decided to implement the decision.

At the end of 2020, all Islamic banks in Bangladesh have 1,311 branches out of total 10,752 branches of the whole banking sector.

Mobilisation of deposits by Islamic banks

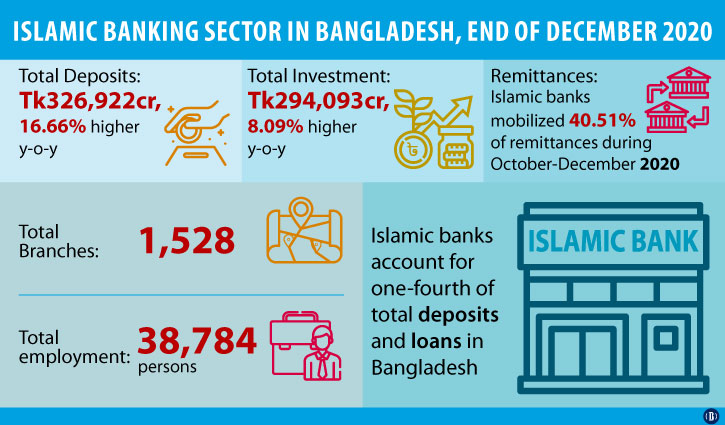

Total deposits in Islamic banking sector reached Tk 326,922 crore at the end of December 2020, which was higher by 16.66% compared to that of the of same month of last year. The share of total deposits of Islamic banks accounted for 25.33% among all banks at the end of December 2020.

Among different types of deposits of the Islamic banking industry, Mudaraba Term Deposits secured the highest position (47.04%) followed by Mudaraba Savings Deposits (18.77%), BB data shows.

Investments

Total investment (loans & advances in conventional banking system) in Islamic banking sector stood at Tk 294,093 crore at the end of December 2020, which went up by 8.09% year-on-year. The share of total investments of Islamic banks accounted for 25.69% among all banks.

Analysing the sector-wise investment, it was found that Islamic banks invest nearly 44% of its total investments in trade and commerce sector followed by industrial working capital financing 23.33%, large and services industry 11.55%, construction 9.05% and CMSM (Cottage, Micro, Small and Medium Industries) 4.65%.

Remittances mobilised by the Islamic banks

Islamic banking industry is playing a vital role in collecting foreign remittances and disbursing the same among beneficiaries across the country. Remittances collected by the Islamic banks in Bangladesh account for 40% of total remittances. Islamic banks mobilised Tk 21,409 crore of remittances during October-December 2020, up 19.24% than a quarter ago.

The Islamic banking sector mobilised 40.51% of total remittances received by the entire banking industry during the quarter under review. Among the Islamic banks, Islami Bank Bangladesh occupied the top position with 74.96% market share in respect of remittance collection during October-December 2020.