After forex, call money market gets heated up

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

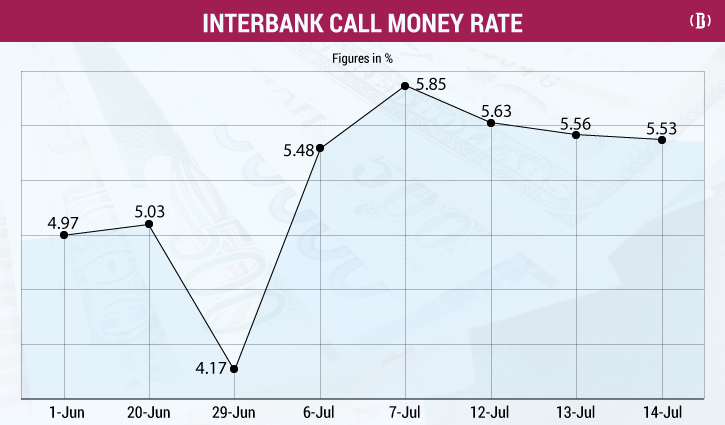

After the foreign exchange market, the interbank call money rate reached above 5.5 percent, a situation that treasury officials in banks did not see at least in two years.

Usually, the call money rate goes up ahead of the two Eid festivals when the demand for cash skyrockets and banks resort to the overnight money market to meet their emergency needs.

But that was not the case now.

After the Eid-ul Azha holidays, private and public offices were opened on July 12 and it was seen that the overnight demand for cash still remained high even in the post-Eid markets.

Bangladesh Bank data shows that the overnight (one day) call money rate reached the highest 5.85 percent (average) on July 7, the last working day before the Eid-ul Azha holidays began. But the average rate remained high at 5.63 percent, 5.56 percent and 5.53 percent on July 12, July 13 and July 14 respectively, indicating that the money market is still heated up.

And, the interest rate for relatively higher tenure loans was much higher than the overnight rate. There were 11 deals worth Tk 418 crore for 4-day-tenure loans on Thursday (July 14) and the average interest rate for this loan was 6.01 percent. As the tenure extends, the cost of these loans goes up. On Thursday, a bank charged 8.25 percent for a 20-day loan of Tk 25 crore in the interbank market.

But this same overnight money market remained very calm in 2020 and 2021 when the rate went below 2 percent because of lukewarm demand.

Bankers said the ongoing stress in the foreign exchange market has had an impact on the local currency money market as the central bank has been pulling out Taka by selling millions of dollars to the banks that need the foreign currency to settle their import bills. The Interbank exchange rate reached Tk 93.95 a dollar on Thursday, up from Tk 86.5 in April because of rising import payments.

BB sold $7.9 billion to banks in FY22 which ended on June 30. But it was exactly the opposite as BB bought $7.6 billion from banks a year ago when the demand for the greenback was at its lowest amid the height of the coronavirus pandemic.