State-run firms’ defaulted loans balloon to Tk 48,000cr

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

State-run firms have been failing to repay their defaulted loans to the state banks for the last 12 years, accumulating their outstanding at a whopping Tk 48,000 crore.

Those firms owe Sonali, Janata, Agrani, Rupali and BASIC banks this huge volume of credit, as of April 30, 2022.

In the last two years, the loan of the state-run firms rose by Tk 8,500 crore. And, some Tk 111 crore became defaulted credit in the last two years.

This outgoing fiscal, a total of 11 public organisations are incurring losses, according to Bangladesh Economic Review-2022.

The financial state of those government-run firms are not getting any better due to various irregularities and mismanagements, a finance ministry source said.

On the contrary, the government has been dragging the losses for a quite long time.

Economist Dr Abdul Razzaque told the Business Insider Bangladesh that the loss generating firms should be privatised as soon as possible. But, even after their de-nationalisation, those firms should be monitored.

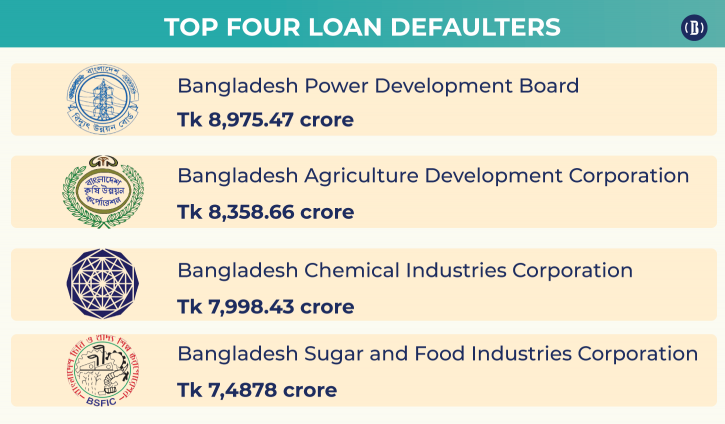

According to the Economic Review, Bangladesh Power Development Board (BPDB) owes the banks most. The total loan of the company has now aggregated Tk 8,975.47crore. The runner up position is owned by Bangladesh Agriculture Development Corporation (BADC) with an outstanding of Tk 8,358.66 crore. And, the third position has been secured by Bangladesh Chemical Industries Corporation (BCIC), with an unpaid loan of Tk 7,998.43 crore.

Bangladesh Economic Review says bank credit of Bangladesh Sugar and Food Industries Corporation (BSFIC) has stood at Tk 7,4878 crore. Much of this loan has been taken from the state-owned Sonali Bank. Bangladesh Petroleum Corporation (BPC) owes the bank Tk 5,066.72 crore, Bangladesh Jute Mills Corporation (BJMC) Tk 1,047.18 crore. Bangladesh Textile Mills Corporation (BTMC) Tk 24.69 crore, state-run communications company BSS Tk 5,255.95 crore and BIWTC Tk 583 crore respectively.

The cumulative loan of Chattogram Port Authority (CPA) has reached Tk 466 crore, Trading Corporation of Bangladesh (TCB) Tk 1,342.25 crore, Bangladesh Water Development Board (BWDB) Tk 567 crore, Bangladesh Steel and Engineering Corporation (BSEC) Tk 200 crore, Bangladesh Tourism Board (BTB) Tk 9.63 crore and Bangladesh Rural Electrification Board (BREB) Tk 97 crore, respectively.

According to the information received, BJMC has an outstanding worth Tk 57.20 crore, BADC has arrears of Tk 21.27 crore and BTC Tk 20.49 crore, respectively.

In the expiring financial year, the losses of state run 11 firms stood at Tk 5,004 crore. The Economic Review data shows the highest amount of loss has been incurred by Bangladesh Rural Development Board (BRDB) at Tk 1,896 crore followed by Trading Corporation of Bangladesh (TCB) Tk 1,159 crore, Bangladesh and Sugar and Food Industries Corporation (BSFIC) 882 crore, Bangladesh Chemical Industries Corporation (BCIC) Tk 552 crore, Bangladesh Jute Mills Corporation Tk 308 crore, Bangladesh Road Transport Corporation Tk 101 crore, Bangladesh Film Development Corporation Tk 22 crore, Bangladesh Inland Water Transport Authority Tk 46 crore, Bangladesh Textile Mills Corporation (BTMC) Tk 17 crore and Bangladesh Inland Water Transport Corporation Tk 13 crore, respectively.

Apart from this, Bangladesh Energy Regulatory Commission has also incurred a loss of Tk 8 crore. In the last fiscal year, the losses of nine firms had stood at Tk 2,060 crore.