Default rate on credit cards shoots up

Ahmed Shawki || BusinessInsider

Graphics by Business Insider BD

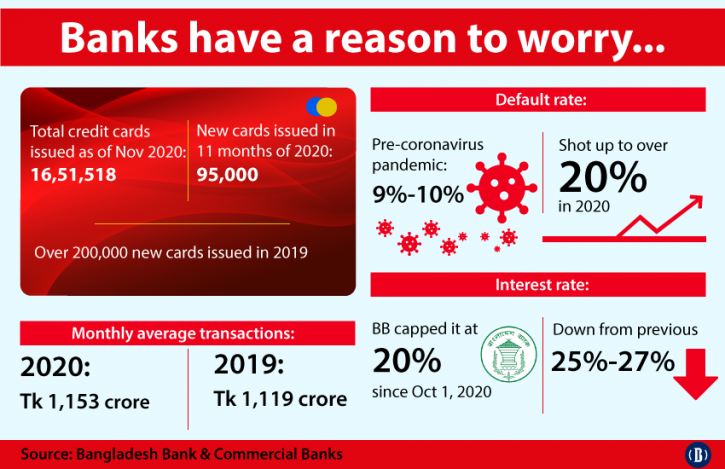

The number of people defaulting on their credit card debts skyrocketed in Bangladesh during the Covid-19 pandemic, which affected consumers in the way of job losses and pay cuts.

According to industry insiders, the pre-pandemic average of credit card default rate was between 9 percent and 10 percent. Now the default rate has shot up to over 20 percent though banks will take some time to get the data after ending of the holiday period on December 31 last year.

The issuance of new credit cards also declined significantly in 2020.

The yearly growth of new credit card came down to 95,000 as of November 2020, down from 2.01 lakh in 2019, according to Bangladesh Bank data.

The transaction volume, however, was Tk 12,692 crore as of November 2020 against Tk 13,432 crore in 2019.

The issuance of new credit cards decreased as banks took a conservative approach during the Covid-19 fallout.

The bank took such a stance due to skyrocketing credit card defaults as people were reluctant to take credit risk in vulnerable job market scenario, industry people say.

“Because of Bangladesh Bank’s moratorium on loan repayments, many cardholders did not pay instalments. That pushed up the default loans on credit cards during the pandemic,” said a senior official of card division in City Bank.

Industry’s average rate of default loan on credit cards rose to over 20 percent, he said.

“The major segment of credit card users is from services sector, which faced major dent last year due to the pandemic. People lost their jobs or experienced pay cuts that pushed down their affordability,” he told Business Insider Bangladesh.

Until October last year the average industry interest rate for credit card was ranging between 25 percent and 27 percent. In October last year the central bank fixed the interest of credit cards at 20 percent.

Ahsanullah Chowdhury, head of card operations of Eastern Bank, said, like all other borrowers, card users also got moratorium till December 31, 2020 and that is why banks could not calculate the default rate.

“Definitely, the default rate has increased, but we will get actual scenario by March,” said Chowdhury.

Mohammed Anwar Hossain, former head of card division of Mutual Trust Bank, said banks were extra cautious in issuing new cards last year.

“Because of the pandemic the job market was vulnerable. Also, lucrative sectors for card usage, like hotel and tourism were in almost shutdown. So, many banks had decided not to be cautious in issuing new credit cards,” he said.

Anwar said the transaction volume decreased because people usually spend credit card for high value expenses, which were at halt during the slowdown.

The average industry default rate of credit card was 9-10 percent which has increased to over 20 percent during pandemic, he added.

Credit card market:

Credit card market is very small in Bangladesh compared to its economy, population and the number of banks. The number is not growing despite its advantage, such as purchases by borrowed money and around 40 days of grace period.

As of November 2020, there were 16,51,518 credit cards issued by over three dozen banks, according to Bangladesh Bank data. Bankers say the number of active cards is less than 15 lakh.

BB data also shows that per month transaction through credit cards remained stagnant at around Tk 1,150 crore for the last two years.

Major players:

Local City Bank is the market leader in the credit card segment in Bangladesh. City became the market leader after it got the sole franchisee of American Express over a decade ago.

Multinational Standard Chartered Bangladesh stands second. Other major banks in credit card are: Eastern Bank, Mutual Trust Bank, Dutch-Bangla Bank, BRAC Bank, etc.