BB rejects People’s Bank licence

BI Report || BusinessInsider

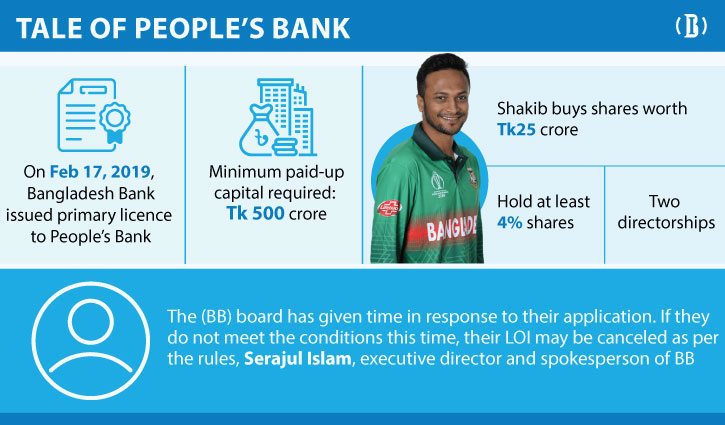

Infograph used by Business Insider Bangladesh on December 21, 2021.

Bangladesh Bank has rejected the application seeking a time extension to meet the conditions of the letter of intent (LOI) issued in favour of proposed People's Bank Limited.

Bangladesh Bank spokesman and executive director Md Serajul Islam confirmed the news to the Business Insider Bangladesh.

The decision to reject the application was taken at a board meeting of Bangladesh Bank on Thursday, he said.

People’s Bank failed to qualify for the final licence even three years after issuing consent from Bangladesh Bank.

Earlier in December last year, the letter of intent (LOI) expired after several extensions.

The bank then applied for an extension of the LOI by adding star cricketer Shakib Al Hasan and his mother as directors.

According to the rules of Bangladesh Bank, an aspiring director of a bank must hold a minimum of 2 percent share. So, a minimum capital of Tk 10 crore has to be provided for each post of director for the People’s Bank.

However, Shakib provided more than Tk 25 crore worth of capital to obtain the fractional ownership of 4 percent or more.

On February 17, 2019, the Bangladesh Bank issued letters of intent (LOI) to three new banks - People’s Bank, Bengal Commercial Bank and Citizen Bank.

Out of these three, Bengal and Citizen Banks have already started their operations. But People’s Bank failed to meet the regulatory requirements, including paid-up capital and prayed for more time until December 2021.

Although nearly three years went by since the initial licence was received from the central bank, People’s Bank was not been able to start its commercial activities.

Bangladesh Bank came up and said while extending the time for the third time: “For special reasons, the time has been extended till December 31 for the last time.”

BB warned that the letter of intent (LOI) issued will be considered void if the applicant fails to apply for the licence through meeting all the conditions within the stipulated time.

Earlier, the company was accused of claiming credit as their paid-up capital which was detected by an investigation. In such a situation, several directors have been withdrawn from the initiative to establish a bank.

Again, two more directors have been dropped on the instructions of the central bank over some alleged irregularities.