IFIC selling shares in Nepal bank at lower than market price, claims Nepalese businessman

BI Special || BusinessInsider

Business Insider Bangladesh published the photo illustration on November 23, 2021.

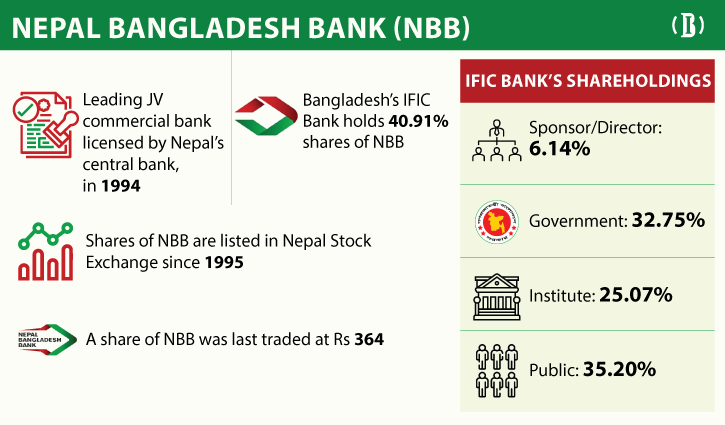

A top Nepalese businessman claimed that IFIC Bank is selling its entire 41 percent stakes in Nepal Bangladesh Bank (NBB) at a lower price than it should get.

Motilal Dugar, chairman of Dugar Group, which wanted to buy the shares at Nepalese Rs 157 per share, claimed this in a letter sent to Salahuddin Noman Chowdhury, ambassador of Bangladesh to Nepal on January 14.

“As there is a government of Bangladesh stake in IFIC I thought of writing to you and meeting you in person to update you about this matter. Do you think it’s fair to end a deal entered 9 months ago without a fair reason and agree to sell to others at the same or even lower?” he said in the letter.

He said another Nepalese businessman Shulav Agrawal of Shankar Group offered to buy the entire stake of IFIC in NBB at Rs 160, which is a much higher rate than the other party has offered.

“So, without exploring this opportunity, how they (IFIC) have agreed to sell in a hurry at a much lower rate. This decision will make the government of Bangladesh lose millions of dollars,” Dugar said in the letter and requested Bangladesh’s top diplomat in Nepal to investigate the matter.

Early last year, IFIC Bank said that it intended to sell its entire holdings in the NBB and accordingly, it had disclosed it to Dhaka and Nepal’s stock exchanges. Since then interested parties in Nepal started contacting the NBB and IFIC Bank in Dhaka to buy the shares.

Dugar was one of those interested buyers. He claimed in the letter that he contacted IFIC and on March 31, 2021 both sides reached an agreement after a lot of negotiations on price to buy IFIC stake in NBB at Rs 157 a share.

“Even, I had sent an official letter of offer to Honourable Salman F Rahman and on April 2 he reverted back with a letter of acceptance,” reads the letter.

Things got delayed at IFIC-end to sign an MoU because of the lockdown in Bangladesh, but he said he was in contact with IFIC through phone calls and emails.

“Further IFIC company secretary informed us about the appointment of a local lawyer and asked us to ask our lawyers to contact their lawyer for finalisation of the MoU draft,” Dugar said.

Then he saw advertisements in newspapers asking existing promoters to apply to buy their stake if they are interested. But that did not puzzle him as he was informed that it was done to comply with the rules of Nepal Rashtra Bank (central bank of Nepal).

Accordingly, he was waiting to sign the deal. But in a surprise, Dugar saw in the media that IFIC might enter into the deal with Chaudhury Group, another leading conglomerate in Nepal. Then he tried to enquiry about this with IFIC, but no response was there. After that he decided to inform the central bank, the finance ministry and the IFIC Bank chairman.

“We wanted him (IFIC Bank chairman) to conclude the deal at earliest as our funds remain idle for so long and other members of our group are getting frustrated and suggesting to take legal actions otherwise,” he said.

“After few days we just got a letter dated 22nd December, 2021 from the company secretary of IFIC saying the board of IFIC has not approved our deal,” he said. Immediately after that he saw in media reports that the deal has been struck with Chaudhury Group and as per reports it’s either at a rate agreed with us or even lower.

“Also, we feel without any reason to decline our agreement of more than 9 months is not fair and also against international business principles. Further using our agreement as a tool to negotiate with other parties is against legal practice,” he told the ambassador of Bangladesh.

Suspecting foul play, he said he went to the court and got a stay order on IFIC’s share sale on January 11, 2022. “But to our surprise even after the stay order by court, Nepal Bangladesh Bank signed a MoU on January 13 to the acquisition (of IFIC shares) by Nabil Bank. Every step of the MoU procedure was done at rocket speed whereas such procedures take months,” Dugar said.

He concluded saying that he hoped the government and people of Bangladesh are not denied the right price for their investment in Nepal.

“We did not know anything about the embargo of the Nepalese court regarding IFIC Bank’s share sale,” Shah Md Moinuddin, deputy managing director and head of international division, IFIC Bank, told the Business Insider Bangladesh on Saturday.