IFIC’s move to withdraw investment from Nepal bank

Nepal businesses seek PM Hasina’s intervention

Asif Showkat Kallol || BusinessInsider

Photo illustration: Business Insider Bangladesh

Nepalese business community has sought Prime Minister Sheikh Hasina’s intervention to make IFIC Bank change its plan to withdraw its investment from Nepal Bangladesh Bank Limited (NBBL).

To this end, the Nepalese business community has recently sent a letter to Sheikh Hasina that apparently contains some emotional arguments in favour of Bangladesh’s investment in the Himalayan country.

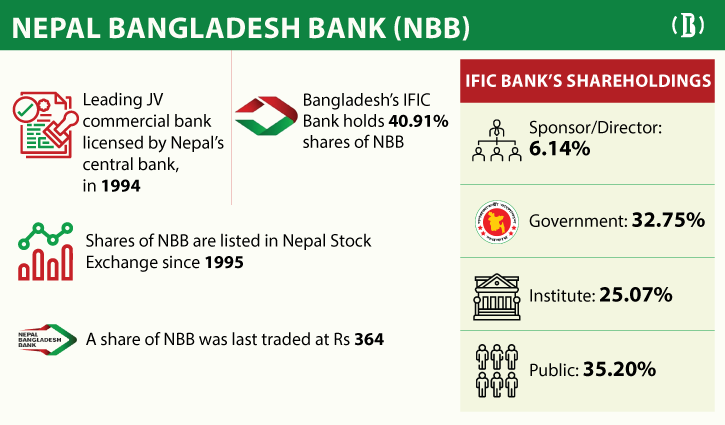

NBBL was formed as a joint venture bank by Nepalese businesses and Bangladesh’s IFIC Bank, where the government still owns one-third shares.

On behalf of the Nepalese business community, LB Shrestha, president of the Nepal Bangladesh Chamber of Commerce and Industry (NBCCI), has written the letter addressing Prime Minister Sheikh Hasina to intervene the matter so that IFIC Bank reconsider its decision to withdraw its entire holdings in the Himalayan bank.

“Excellency, the establishment of NBBL has brought the people of Nepal and Bangladesh much closer and the name of Bangladesh has become very much familiar and a day-to-day name for the hundreds of thousands of Nepalese people,” says the letter.

The letter also reads that the NBBL has now more than 100 branches spread across the country—from cities to villages—and has accounts of more than 500,000 customers.

“In short, people call ‘Bangladesh Bank’ instead of Nepal Bangladesh Bank. The bank is doing very well and giving a very good annual return to the investors, which have enabled IFIC Bank to earn millions of dollars every year as dividends,” says the letter.

In the letter, Shrestha also said that it seems IFIC Bank is contemplating to take back the investment from Nepal and sell their shares to Nepalese investors.

“Excellency, while this will not be a right financial decision for the bank (IFIC) to sell the shares at this point of time because the share prices are in the increasing trend and will cross the index double by next year. On the other hand, the withdrawal of the investment from Nepal will not give a good message to the common people and business community of two countries,” reads the letter.

“The name of Bangladesh will be totally vanished from the banking sector of Nepal. It will also affect the common people’s confidence in Bangladesh’s banking capabilities and goodwill.”

Shrestha, therefore, made an appeal on behalf of the entire business community and general people of Nepal requesting the prime minister of Bangladesh to kindly reconsider the IFIC Bank’s investment withdrawal move.

The letter has been sent to the finance ministry via the foreign ministry of Bangladesh.

“We have sent the letter to the Prime Minister’s Office for a final decision in this regard,” said a senior official of the finance ministry wishing not to be named.

The president of the NBCCI also appreciated the steady economic progress of Bangladesh. He said Bangladesh reached lower-middle income status in 2015 and is on track to graduate from UN’s least developed countries (LDC) list in 2026.

“We are also happy to know that your kind hands to some countries that really need financial assistance. Bangladesh also provided $250 million loan assistance to Sri Lanka through currency swap and also you have extended your helping hand to Sudan and Somalia. Bangladesh promised to contribute to waive the debts of Sudan and Somalia. Those are really historic initiatives which have internationally proved that Bangladesh’s economy is much stronger,” says the letter.