BB relaxes credit risk rating for borrowers

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

The Bangladesh Bank (BB) has relaxed the credit risk rating system to facilitate borrowers having easier access to bank loans amid the lingering Covid-19 shock in the economy.

This facility will remain in effect till the end of 2023, said a central bank circular issued on February 23.

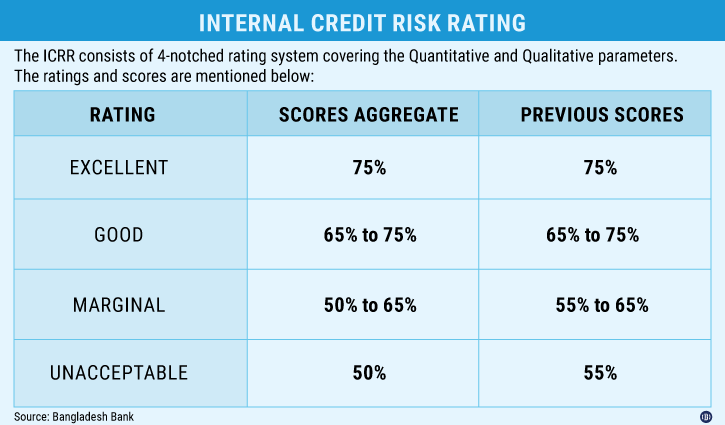

To this end, the BB has revised its Internal Credit Risk Rating (ICRR) system.

Under the latest changes, lenders will classify their clients as Excellent with having a score of 75, Good with a score of 65-75, Marginal with a score of 50-65, and Unacceptable with a score of 50.

The central bank did not make any changes to the “Good” and “Excellent” criteria.

These scores are given after analysing the clients' last audited financial reports.

The circular said that companies are facing problems securing new loans or rescheduling a previous one due to the pandemic.

It is evident in the financial reports of some companies in the industrial, trade and services sectors which shows weak performance in 2020 and 2021, compared to the previous years, said the circular.

ICCR is a mandatory rating system for banks in issuing credit to their customers. ICRR score consists of a 4-notched rating system covering the quantitative and qualitative parameters of borrowers.

The ratings – excellent, good, marginal and unacceptable – are integral for banks to decide who can take out loans